How to Apply for Sukanya Samriddhi Scheme

Applying for the Sukanya Samriddhi Scheme is simple and parent-friendly. An account can be opened at any post office or authorized bank branch. Parents or legal guardians of a girl child below ten years of age can apply by filling a form, attaching identity proof, birth certificate, and address proof.

Documents and Initial Deposit

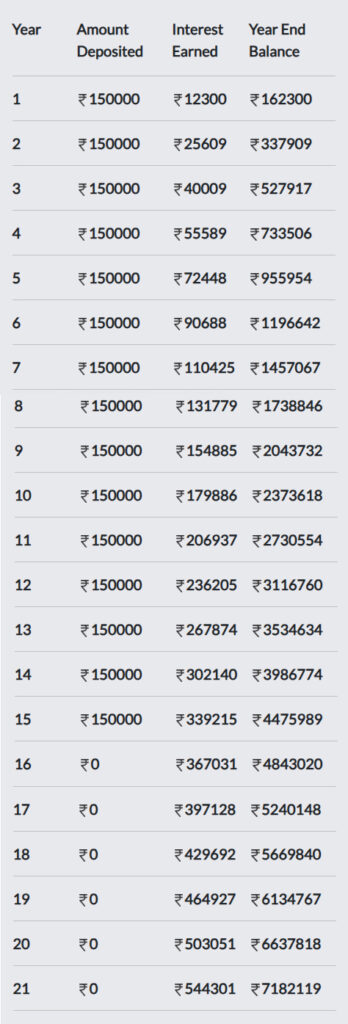

The process of opening the account requires an initial deposit, which can be as low as ₹250. Following the initial deposit, parents or guardians are allowed to save as much as ₹1.5 lakh in a financial year under this scheme. The account is then operated in the child’s name, ensuring savings directly connect to her future needs and financial security.

Interest Rate in Sukanya Samriddhi Scheme

The interest rate in the Sukanya Samriddhi Scheme is revised by the government every quarter. Generally, it is one of the highest among small savings schemes. The amount deposited earns compound interest annually, which significantly boosts the maturity value, creating a sizable corpus for education or marriage expenses.

Safe and Risk-Free Returns

Parents find this scheme attractive because the interest earned is not affected by market risks. In contrast to stock market investments, the Sukanya Samriddhi Yojana offers assured returns since it is fully backed by the Government of India. This makes the scheme suitable for conservative investors who prefer stability over uncertainty while still ensuring growth of their daughter’s savings.

Tax Benefits of Sukanya Samriddhi Scheme

One of the major benefits of the Sukanya Samriddhi Scheme is the triple tax advantage. The money deposited, the interest earned, and the maturity amount are all exempted from tax under Section 80C. This unique feature makes it a powerful tool for long-term family financial planning.

Promoting Financial Discipline

The scheme also teaches families financial discipline. Since the account runs for 21 years or until the girl marries after turning eighteen, parents are encouraged to save regularly. This consistent contribution gradually builds a large fund, removing last-minute financial worries about education or wedding costs.

Partial Withdrawal Facility

Another important benefit is partial withdrawal. When the account holder turns eighteen, half of the accumulated savings can be taken out to meet higher education expenses. This ensures her academic goals are supported without delay, while the remaining amount continues to grow for future requirements such as marriage.

Application Form

Complete Details

Overall, the Sukanya Samriddhi Scheme blends security, growth, and social purpose. It gives parents peace of mind, knowing that their daughter’s future is financially protected. With its attractive interest rate, tax-free benefits, and disciplined savings system, the scheme stands as one of India’s most thoughtful government initiatives.